When someone sells a house, gets a windfall of a million bucks, and then somehow ends up drowning in a sea of debt, it’s bound to raise eyebrows. Especially when that same person has to face the IRS with a bill for $179k and creditors breathing down their neck for another $100k. This story has become a rallying point online, capturing the attention of those who have been there, done that, or just love a good trainwreck of life choices.

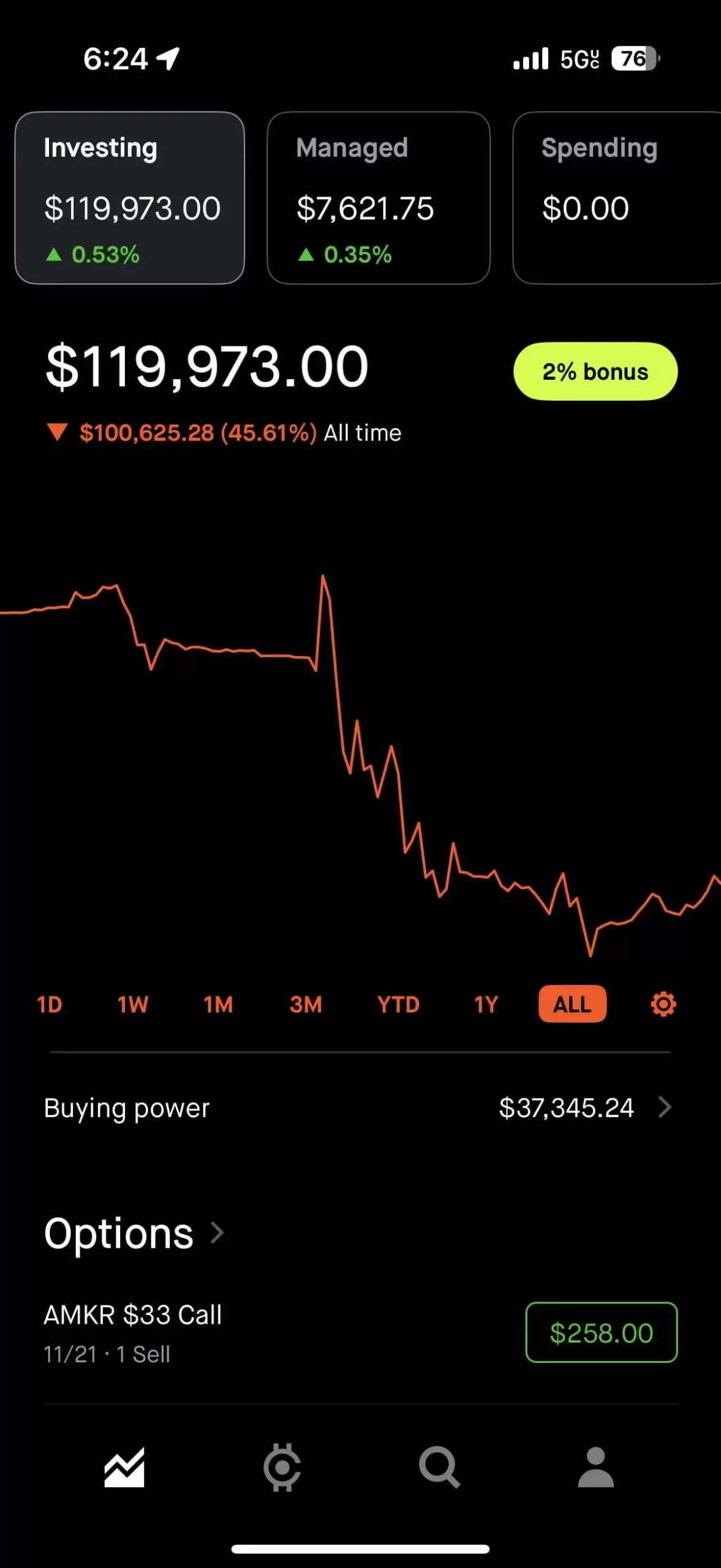

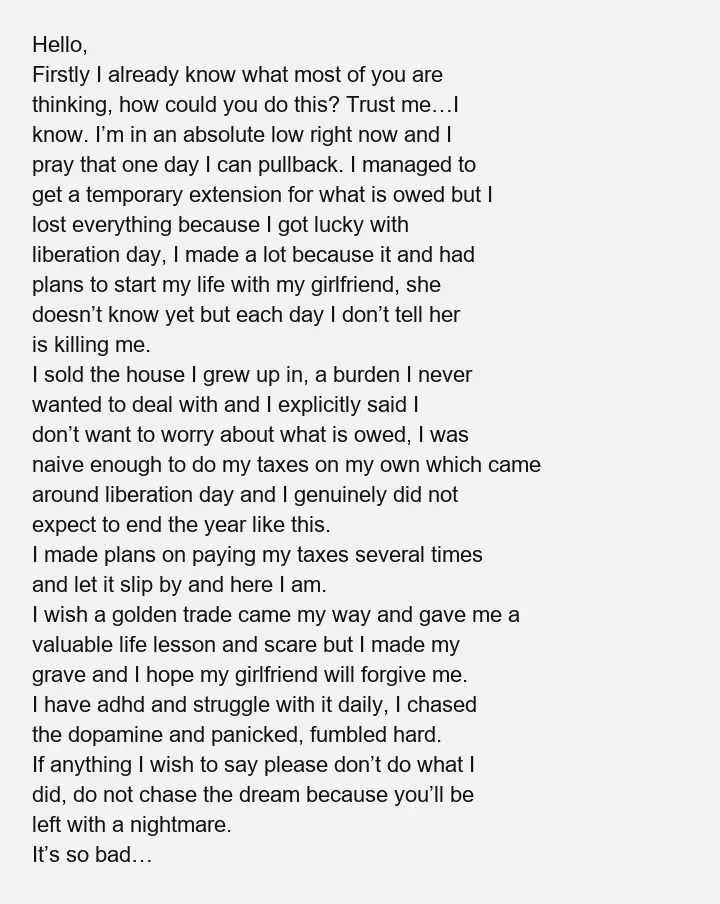

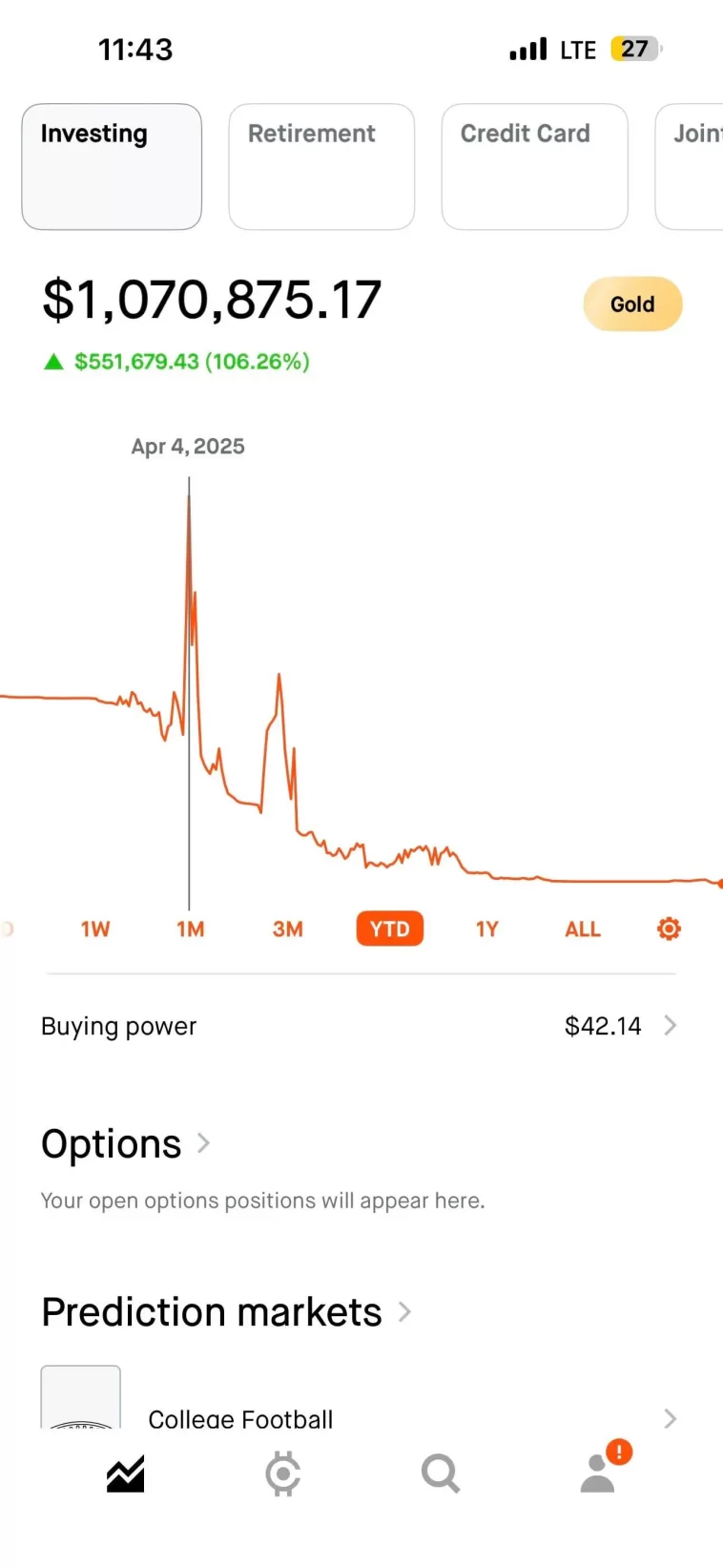

This situation first popped up in a thread that many Reddit users were lurking in, where a user laid out their tale of financial chaos. The original post hit hard, detailing the highs of selling a childhood home and the lows of mismanaging newfound cash thanks to a dive into options trading. It’s like a cautionary tale that everyone knew would come back to bite, but still, it’s wild to see just how fast things spiraled.

As more people chimed in, the discussion took off. Comments flooded in—some sympathetic, others filled with that mix of disbelief and judgment that’s so prevalent in online forums. The phrase “do not do options if you have ADHD” started to resurface, echoing a sentiment that many could relate to; the impulsivity, the chase for that quick dopamine hit, and the harsh reality check that follows. The vibe was almost communal in its understanding, like a collective gasp followed by a shared head shake.

People couldn’t help but weigh in on the sheer scale of the wreckage. The naivety of handling taxes solo, the pressure of keeping the mess a secret from a partner, and the sinking feeling of having to pull all-nighters trying to figure out a way out—those details became talking points in their own right. There’s this overwhelming sense of, “How could it get this bad?” but also an understanding that life can really throw curveballs when least expected.

The whole thing feels like a cautionary story that slaps hard but is also oddly captivating. It’s the kind of trainwreck where the viewers can’t look away, wanting to learn from another’s missteps while feeling that strange mix of empathy and disbelief. There’s something about watching someone navigate the fallout of their choices that resonates deeply, a reminder that the road to financial freedom can be more like a minefield for some. And amidst all the reactions, there’s this lingering thought that maybe, just maybe, this could be a lesson for everyone else, even if it doesn’t quite settle the chaos for the person at the center of it all.

GIPHY App Key not set. Please check settings